A 700 credit score will give you many options when it is time to apply for loans and credit cards. In addition, you can expect to pay lower interest rates. You also have the option of a number of credit cards. These include rewards cards with platinum or diamond status. For instance, Diamond cards give you 6 percent cashback for purchases. These cards can only be obtained by people who have good or excellent credit. For those with credit scores above 700, Bank of America offers a more generous credit policy.

Credit score of good standing

Lower interest rates are available for credit scores below 700 You can reduce your down payment and receive lower interest rates by knowing the factors that impact your credit score. A high credit score can help you get better credit when applying for loans or credit cards. To improve your credit score, start by improving your payment history and utilization ratio.

If you are looking for a personal loans, a credit score of 700 is a great start. Keep an eye out for bad offers, high rates of interest, and terms which could lower your credit score. You should also make sure that you compare interest rates with other loan offers to see which one is the best.

You need to have good habits and work hard to build credit. While there is no single way to obtain an excellent score, the credit bureaus look at payment history and the amount of revolving credit on your report. High credit scores are a sign creditors will take your financial situation seriously. This means that you make on-time payments, keep revolving credit to a minimum, and don't open or close too many accounts.

Fair credit score

Having a credit score of 700 is considered to be a fair score. This score is slightly lower than 711, the average score. This is not a bad score. However, it is important to note that it will be harder to obtain credit cards with a score of 700 than with a higher score. Your income and debt to income ratio are important factors. There are many options to improve your credit score.

First, it is important to recognize that different credit score ranges are available for people with different credit histories. For example, an average credit score of A in Credit Utilization will offset a low account age of B in Accountage. This is why it is so important to see the entire picture. If you have a variety of credit profiles, a 700 credit credit score is more possible.

It is important to remember that rebuilding credit requires patience and time. It is possible to get a loan even if you have a low credit score. Try to get as many revolving line of credit as you can. Installment loans may be a better option for you if you don't have 700 credit.

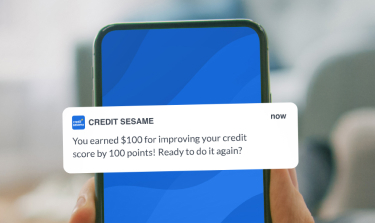

Avoiding late payments is another important factor in improving your credit score. Your credit score could drop as high as 100 points if you miss one payment. You can delay credit recovery up to two years if you are late on your payments. You may be eligible for a lower interest rate if you make timely payments.