It is important to keep your credit score up, as it will save you money on interest. A high credit score can help you find the best possible rates for borrowing. If you want to finance a large purchase, such as a house, car, or any other expensive item, a good credit rating can help.

How to maintain good credit

Paying your bills on-time and maintaining a low balance on revolving credit accounts are just two of the many ways you can keep or improve your score. Your credit score can help you spot any problems early and take action before they escalate.

You should first review your credit history from each of the three major consumer reporting companies (Experian Equifax TransUnion). You can get a better idea of your score by checking your credit report. If you find something suspicious, or think that you may have been the victim, you should contact the credit bureaus and correct the information.

Your payment history is the main factor that determines your credit score. Pay your debts as soon as possible and in full. This is a simple way to boost your score. You can achieve this by setting automatic payments or setting alerts that remind your to pay on time.

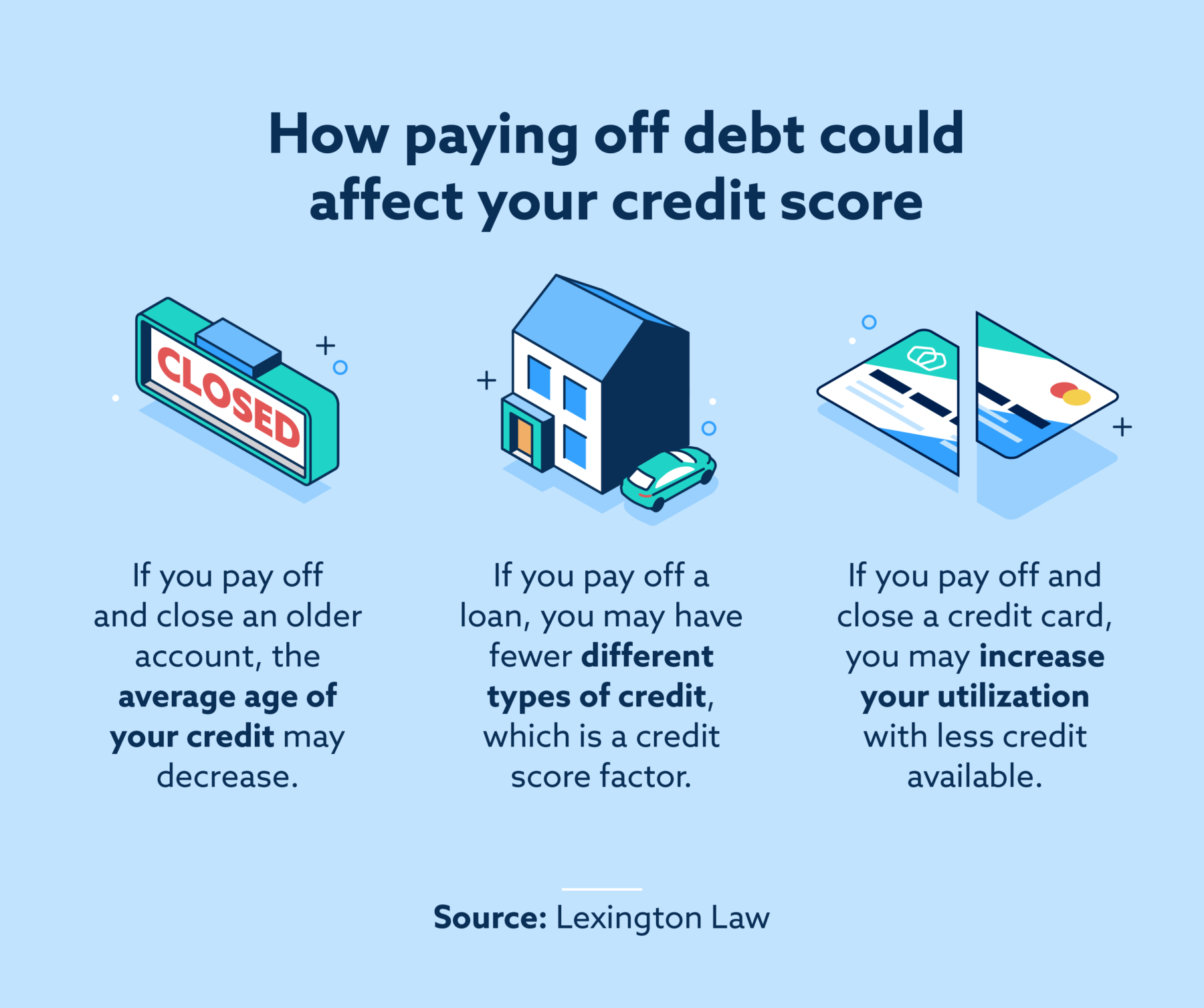

Credit utilization is another part of your score that is important. It shows how much credit you have used. It's typically best to keep your credit utilization rate under 30% so lenders know you're only using the amount of credit that's necessary for your expenses.

Do not open multiple credit accounts within a short time period. This may appear to be risky for lenders. Opening a lot of accounts can also lower your average account age, which can hurt your credit score.

You can limit the use of revolving debt by maintaining a credit limit of at least 30% on your cards. This will let the credit bureaus know that you have an even mix of credit types, which can help improve your credit score.

Your credit score is also affected by the mix of loans you have. Credit scoring models calculate your score by taking into account how well you manage various types of loans from credit cards, mortgages, and personal loans.

Credit cards can help you build a good score as long as they are used responsibly. You should only charge the card a small amount per month, and make your payments on schedule.

You can also shift your debt around if you lower your credit utilization ratio and pay off the debt on lower interest accounts before focusing your attention on the high-interest ones. It can improve your score but you should focus on reducing your debt as quickly as possible.