Credit card balances are the amount you owe. This can change from one statement into the next, or even from one day to another depending on how you use your credit cards.

Many credit card balances are different, which can make them difficult to understand. You should know how a credit cards balance affects your daily life.

Credit card balance - means, definition, and meaning

A credit card's balance is the amount that you owe to your credit card. The balance is typically shown in your credit card bill or account summary.

Your credit card balance can be a great way to manage your finances and keep track of your spending. It is also important to pay your credit cards in full, on time, and without interest.

Your credit card balance can be found by logging in to your account online, or through the mobile app of your card issuer. Your credit card balance, along with the minimum payment due, will be displayed.

You owe the current balance at any time. This number could be higher than what is on your statement, especially if purchases were made during the grace period for your credit card.

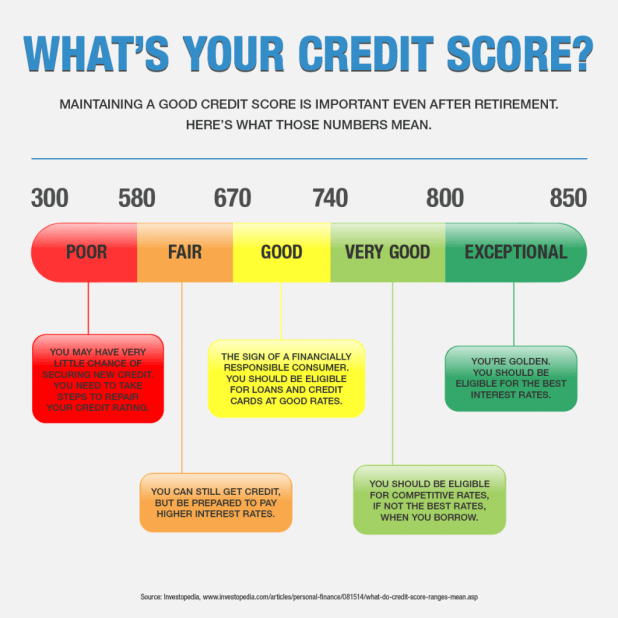

The current balance on each card can help you determine how much credit is available for your other cards if you have more than one. If you want a high credit score, your balances on each card must be lower than 30% of the total credit limit.

Your current balance will also help you keep track of your credit use ratio. That is, the ratio of how much credit you're currently using to the total available credit. This ratio will have an adverse effect on your score, particularly if its above 30%.

A credit card balance increases when you make a purchase on your credit card or charge something to it that exceeds your maximum credit limit. The charge is added onto your credit card account and can be used to calculate the interest due on your next billing cycle.

It is easier to maintain credit utilization ratios and raise your score when your card balance falls. It can also help you understand how much credit you have available to spend and when to apply for new credit or a credit limit increase.

It is possible to transfer a balance, in whole or in part, from one credit card into another. This can save you time and money, and a credit card balance transfer fee is typically waived on most of these transfers.

It can be difficult to keep track of the balance on your credit card, but once you do, it becomes easier to stay in control and manage your debt. It is important to know how to budget your money, to avoid interest and to pay off the bill by its due date. This will help you avoid a lower score.