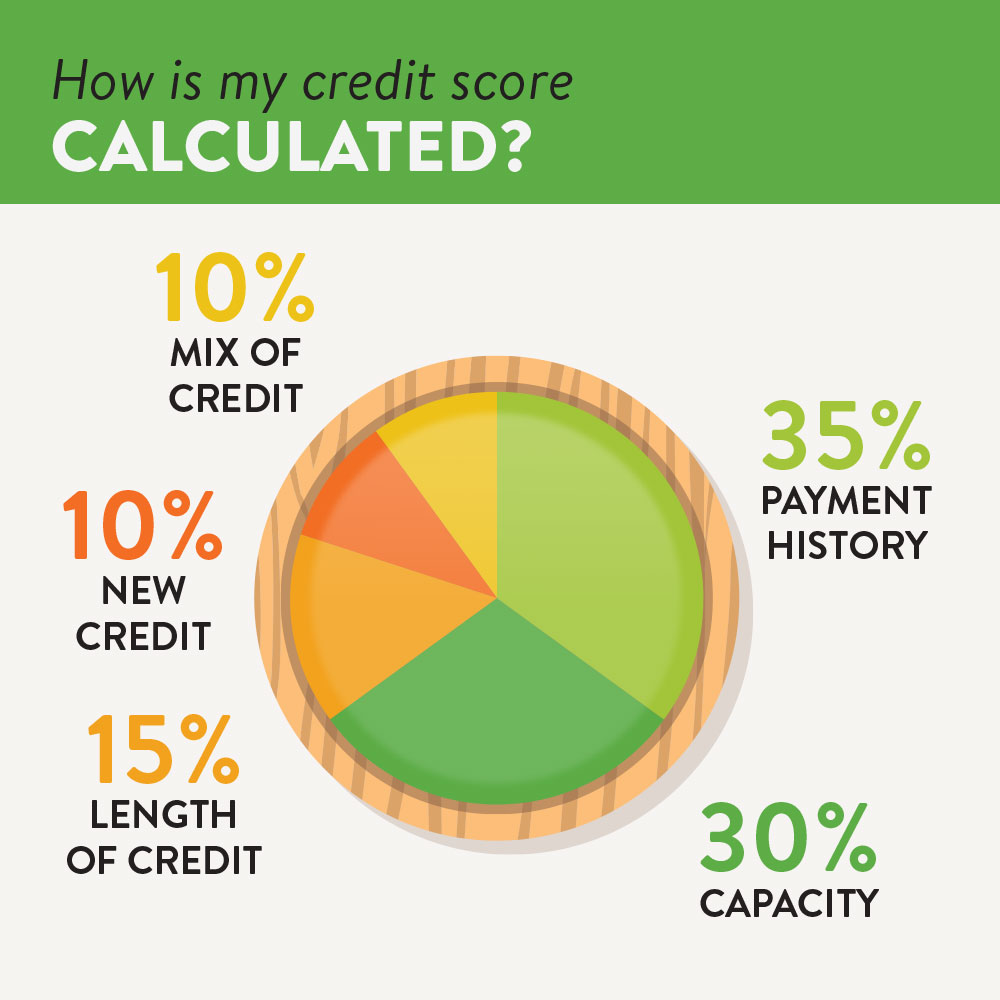

To build your credit score, there are many options. One is to make payments on time and to pay off the card in full each month. Your credit score will improve by using your card responsibly and keeping credit utilization at a minimum of 30%. You can also try other methods to improve your credit score, such as locking your credit card in a drawer and not using it.

Credit card benefits to help build credit

When using a credit card to build credit, it is important to make minimum payments on time. Missed payments can cost you extra money, including a late payment fee and losing promotional interest rates. Autopay can be set up on your card to prevent missing payments. Autopay automatically makes minimum payments and pays the balance.

You can also build credit by becoming an authorized user on a family member’s card. This option is great for building credit because you can purchase on both of your accounts. You will also have a history under both of your names.

Although credit cards can be used to build credit and finance large purchases, it is important to keep your spending low. A high balance could lead to high interest rate and cause credit damage. There are many credit cards that offer perks like rewards points or cash. However, remember to make only the purchases you can afford and make monthly payments.

Keep track on your credit card purchases

It will help you to build credit history if you are using credit cards to pay your bills. It can also help you budget. You will be able to keep track of when your payment are due so you can avoid paying late fees. It will also alert to fraud charges.

Although credit cards are convenient, you need to be cautious not to spend too much. Spending more on a credit card than you currently have is a good idea. You could end up paying high interest fees, which can damage your credit. It's important to make payments on time each month. Even if you feel like you can afford the purchase, you need to be able to cover the bill if you lose your job or have an emergency.

You can also use budgeting apps and mobile apps to track your credit card purchases. These apps make it easy and inexpensive to track spending. You can also view transactions in real time. It can be a great way for you to improve your credit score by keeping track of your purchases using a credit card.

Get a cosigner

Co-signing a credit card can help build credit. This is good for both the lender and you. Having someone with good credit as a co-signer reduces the chances of default and helps both of you improve your credit scores. It also diversifies your credit mix. Co-signers need to be aware that if the loan is not paid on time, the co-signer could be sued by the lender. The lender can also sue the borrower for co-signing.

You don't have to get a cosigner for your credit card. There are other options that can help you build your credit. You can first consider becoming an authorized user for a credit card. You don't have to worry about a cosigner. Instead, you can use your name as the cosigner on a credit card. Some issuers will report your identity to credit bureaus.