Unsecured loans can be obtained without collateral but still carry interest and fees. These types of loans include credit cards, personal loans, and student loans. Your repayment history and credit score will be used by the financial institution to decide whether to give you an unsecured mortgage. Unsecured loans typically have higher interest rate than secured loans.

Unsecured loans don't require collateral

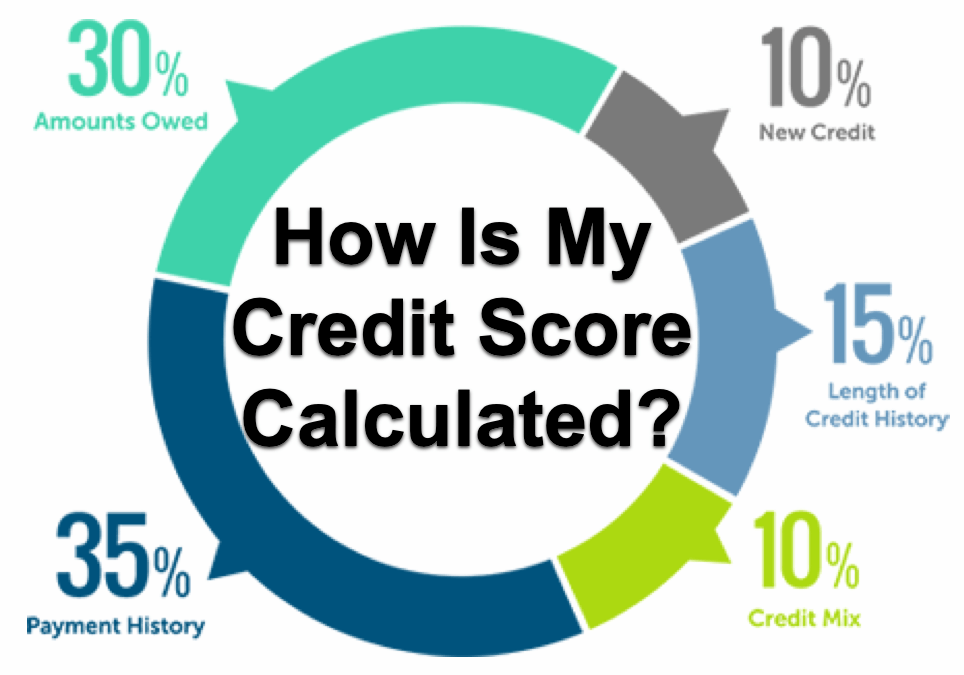

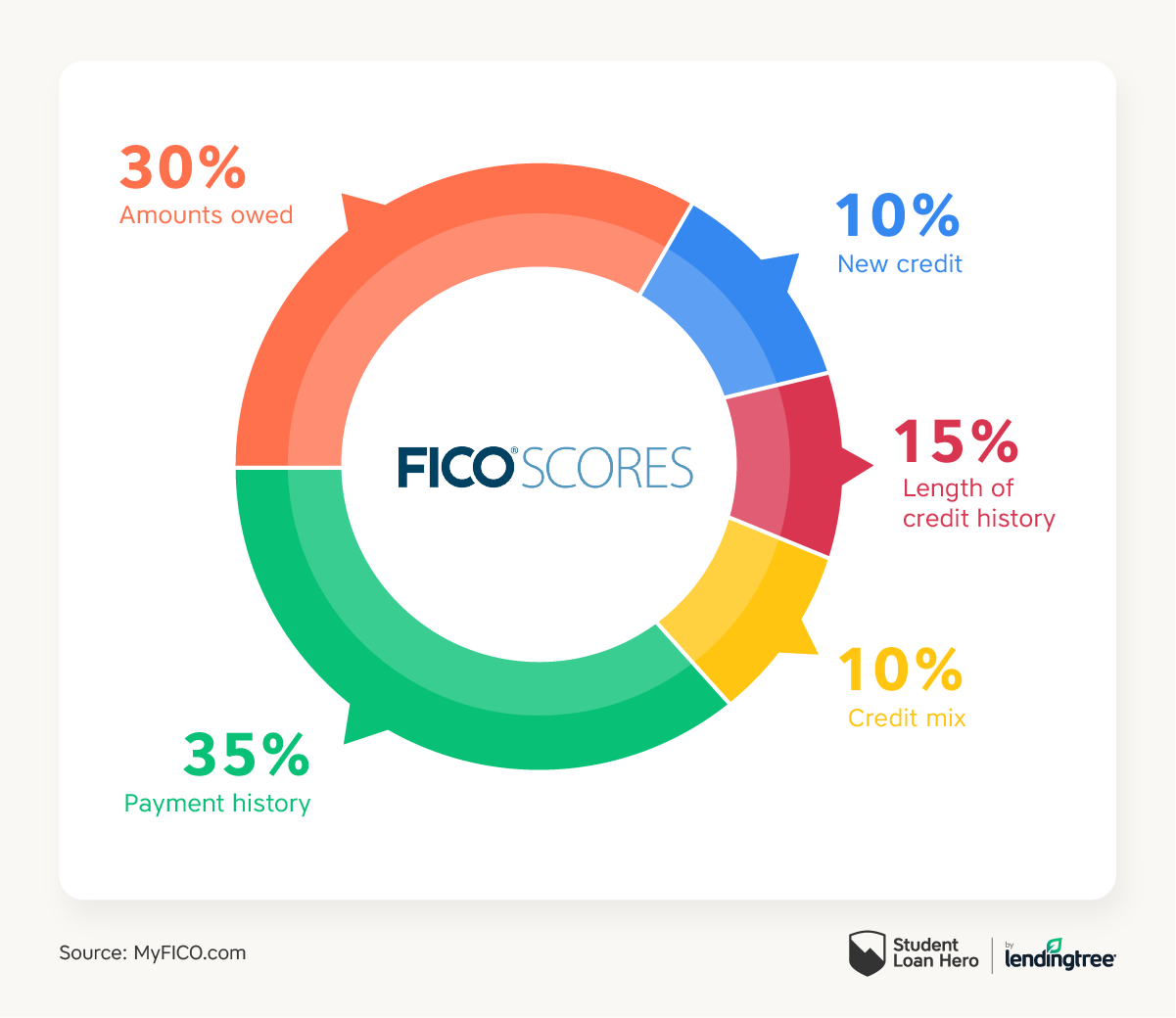

Unsecured loans are an option for borrowers who don't want to put their house or car up as collateral. However, lenders have certain requirements for these loans. They want to see proof that the borrower can pay back the loan. Because of this, they may want to see a borrower's credit score. The best chances of approval for an unsecured loan are generally those with a credit score above 700. Unsecured loan approval is also affected by your income. The lowest interest rates are usually available to those with a high income and good credit history.

It is also easy to get unsecured loans. The application process for most online lenders is quick and requires minimal personal and financial information. Borrowers can complete the application within minutes and receive a decision in an instant. Unsecured loans do not require collateral so they are beneficial for people with poor credit.

Unsecured loans have higher interest rates

Unsecured loans tend to have higher interest rates that secured loans. Although secured loans offer more borrowing options and are less risky to lenders, the upside of unsecured loans is that they have higher interest rates. If you have bad credit, however, an unsecured loan might be better. If you default on payments, you may lose your collateral, and could find yourself in deep debt.

Unsecured loans are much riskier for lenders as they can end up sending your unpaid balance to collections or filing a lawsuit if you cannot make your payments. Unsecured loans may be used to finance home improvements, debt consolidation, car purchase, education, health bills, and vehicle purchases. The interest rate on an unsecured loan can vary from three percent to 36%, which is higher than on a secured loan.

Lenders are more likely to approve them.

Unsecured loan are those where the borrower gives no collateral like a car, home or other assets. Unsecured loans are more risky for lenders and will be charged a higher interest rate. Unsecured loans have the advantage that borrowers will not lose their property and assets if they default in payments. These loans can be personal loans, credit cards or revolving line of credit.

If a borrower has good credit, unsecure loans are more likely that they will be approved. However, borrowers with a lower credit score can still qualify, but they will have to pay a higher interest rate. Unsecured loans can also be obtained online and in person. Local lenders may offer lower interest rates and flexible terms.

They have longer repayment schedules

Unsecured loans, which aren't secured with collateral, pose a higher risk for lenders. This means that interest rates and repayment times can be longer. The downside is that unsecured loans can be easier to qualify for, but you may pay more in the end. This is why you should shop around for the loan that suits your needs.

Unsecured loans can be obtained through credit unions, banks, and online lenders. Pre-qualification is available from many online lenders. This allows you to compare different lenders and loan terms before you apply. Some lenders even allow you to pre-qualify without impacting your credit score. Unsecured loans have another advantage: you don't need to place collateral, so you can get the money you need quicker.