Credit cards have become the most popular option for cash back rewards. In 2020, the welcome bonuses were insane! In 2022, the top 6 cashback credit cards will be available. One of these cards, combined with another, could earn you enough cash to travel for free. You can also earn points which you can redeem for gift certificates.

Wells Fargo Active Cash(sm), Card offers 2% Cash Back

Wells Fargo offers several rewards programs, including Active Cash(sm), which gives you 2% cash back for your purchases. In exchange for spending a minimum $1,000 on the card in three months, you could earn up to $200 cash rewards. Redeem your cash rewards to receive gift cards or a statement credits on eligible Wells Fargo account accounts.

The card has no annual fees and offers a sign-up bonus that is great incentive to use it. The only catch is that you need to spend at least $1,000 within three months of account opening to receive the bonus. The card has many other drawbacks. Although it offers 2% cashback, it is still one of the very few cards that does so.

While other rewards cards can offer a similar amount, the Wells Fargo Active Cash(sm), with no annual fee, is an excellent choice for rewards cardholders. Its 2% cash back is unlimited and can be used to supplement other rewards cards. You can also get a promotional financing option with this card, making it a good choice for consumers with other credit cards.

Get 5% cashback when you join Discover it Cash Back

Discover it Cash Back is a great credit card for those who like to earn rewards without an annual fee. This card rewards you with 5% cashback on rotating quarterly bonus categories, and one percent cashback on everything else. You can get more rewards for your everyday purchases with better options. Citi Double Cash Card gives you an unlimited 2 percent rebate on all purchases. It is also more beneficial to those who make their monthly payments.

The Discover it(r), Cash Back credit card is for those with good credit scores. It waives the first late payment fee. The credit card also has great benefits such as no annual fees and no penalty APR. This makes it a great choice if you spend less than $2,000.

Capital One SavorOne cash rewards credit card

The Capital One SavorOne cash rewards credit card may be right for you if you are a foodie who has a large grocery bill. The rewards are non-expire and you can earn cash back on dining out, entertainment and grocery shopping. This card is a great option for budget-minded foodies. This card has no foreign transaction fees, annual fee or foreign transaction fees.

Capital One SavorOne Cash Rewards Credit Card has good cash-back rates, and there is no annual fee. It also offers perks on dining, entertainment, grocery stores, and streaming services. You'll also have the added benefit of 0% introductory APR, which makes it a great choice for a low-income consumer.

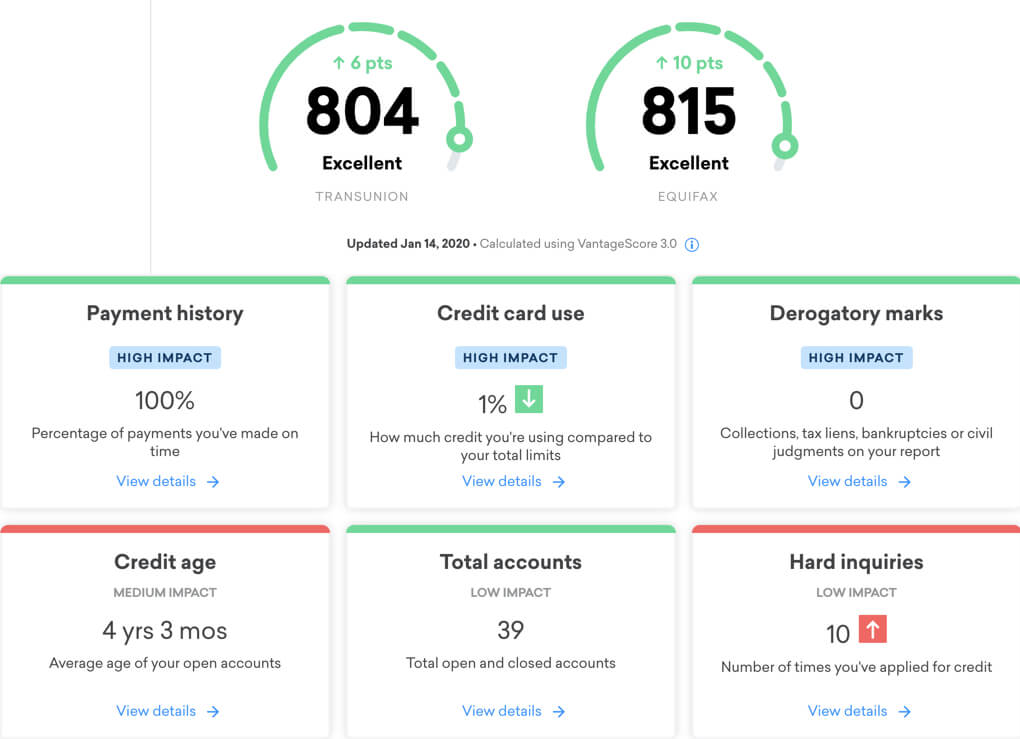

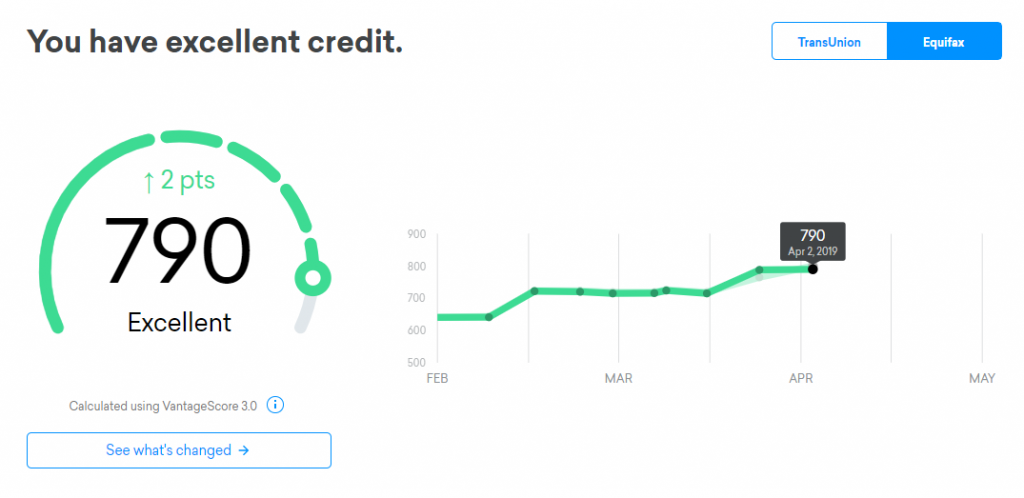

It's crucial to verify your credit score before you apply for the Capital One SavorOne Rewards Credit Card. You can check your score online on the Capital One website. It may be difficult to get approved if you don't have perfect Credit.