These tips will help you maintain good credit standing. To begin with, you should avoid opening new credit lines. Next, make sure that you have paid off any collections accounts and charge-offs. Also, diversify your credit mix by keeping credit cards open. This will keep you from accumulating large amounts of debt and will increase your credit score.

Avoid applying for new credit

When it comes to credit cards, the best strategy is to avoid applying for new lines of credit. You will lose your credit score if you apply for a new line of credit. If you have existing debt, it is a bad idea to apply for credit lines. Instead, pay off existing debt and save up for large purchases. Good credit can help you get the best rates for loans, credit cards, or rental apartments.

Diversify the credit mix

You should have a mixture of both installment and credit. Open a credit line and make your monthly payments. This is the best way to utilize revolving credit. To avoid interest, limit the amount you charge to your credit card so that you don't accumulate it. To prove that you can manage both installment loans and personal credit, you might consider getting a small personal loan.

Pay off charge-offs or collection accounts

While it can be difficult to get rid off charge-offs or collection accounts, it is definitely worth trying. While this process will take a while, smart planning can help you accelerate the process.

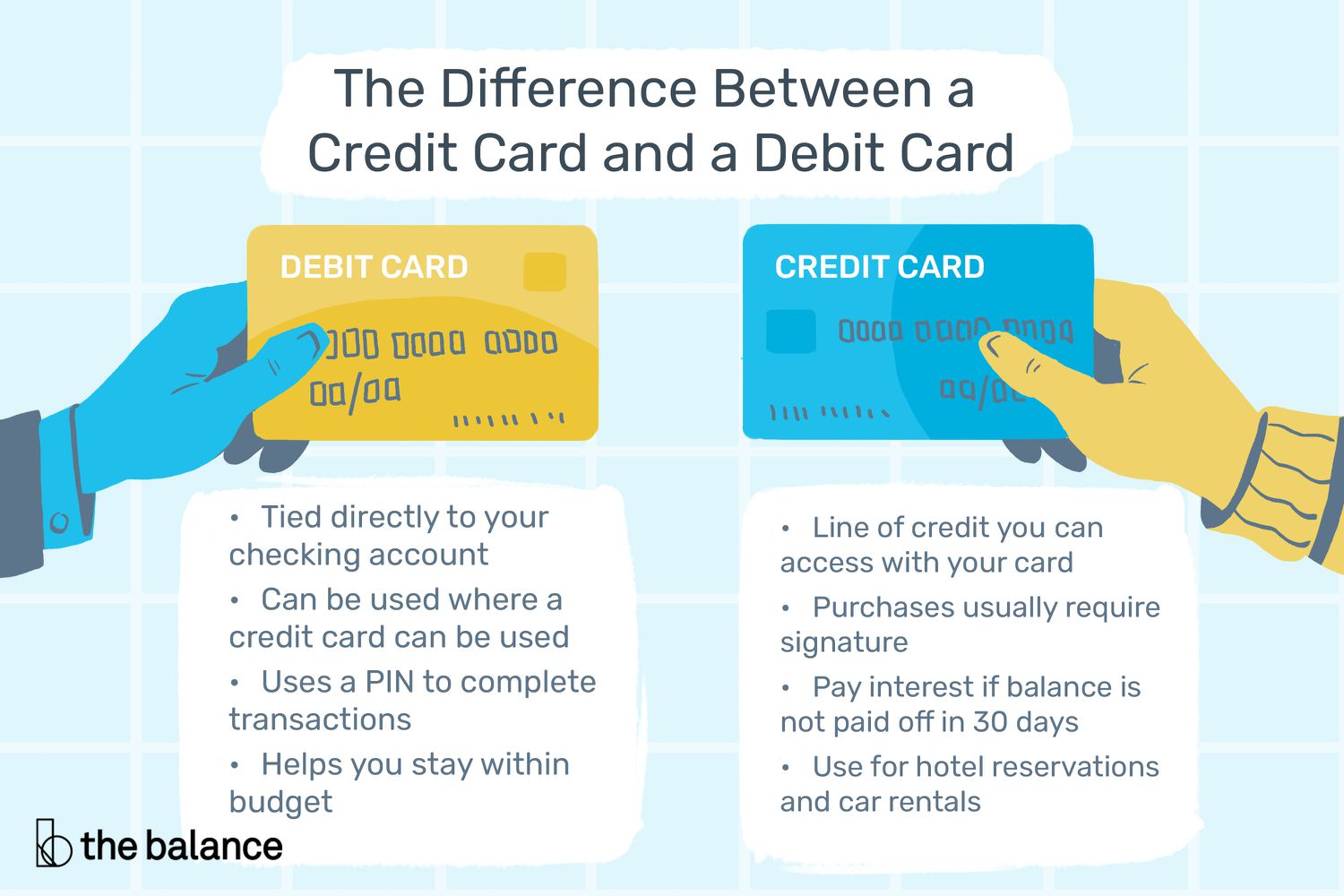

Credit cards: Keep your eyes open

The best way to maintain a high credit score is to maintain at least one credit card account. You must use your credit card account regularly. This is not just to keep it open for the privilege of using. Multiple accounts can complicate tracking and raise fraud risk. While it is recommended to keep all your accounts open at all times, experts suggest that you only have one card.

Do not ask for too many details

Credit scores can be lower if you apply for too many credit cards and loans within a short period. A single inquiry will not affect your credit score. However, it is better to avoid multiple inquiries throughout the year before applying for any mortgage or loan. Hard inquiries are permanently recorded on your credit file for one year. Remember that lenders might consider other factors when making credit decisions.

Avoid closing credit cards while you have balances on other cards

To maintain a high credit score, it's important to avoid closing credit cards while you have balances on another card. Your credit score is dependent on the activity reported on your accounts. You run the risk of becoming "credit invisible" if you close a credit card without paying it off. Some credit card companies will waive annual fee or convert fee cards to no-fee cards, if you pay the fees in a reasonable amount of time.