If you don't know what bad credit means, chances are that you've heard it before. This article will help explain what these terms mean, and how they could impact your life. Your ability to borrow money or get credit cards will be negatively affected by a low credit rating. You'll find out how debt consolidation can help you improve your credit score.

Get a subprime rating on credit

There are many ways to improve subprime credit if your score is below the prime. Sometimes your credit score can be quite low, but it can still have a negative impact on your life in other ways. A credit score of less than 620 is considered subprime credit. You may need to pay $300 deposit if you want to apply for a card. By making on-time payments on this card, you'll eventually be able to build your credit score and obtain a higher credit limit.

Some people are concerned about how long it will take for prime credit to become subprime. It all depends on how your credit file looks. For a full year, you can check your credit report for free each week. Your credit score will be affected for seven years if you miss a payment. Another important issue to address is a high credit card balance. Credit card balances can make it harder to pay off the card in full.

There are other factors that could affect your credit score

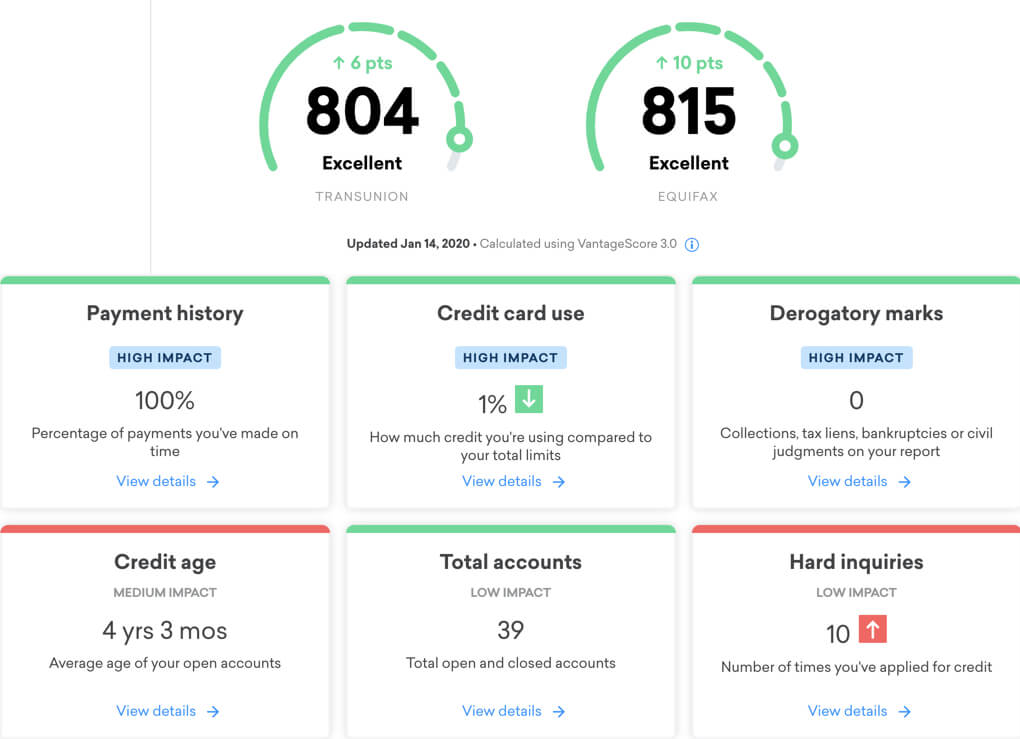

Your credit score is one the most important parts of your financial lives. Your credit score can impact your ability to borrow money, your utility deposits, and even your chance of purchasing a house. Although credit scoring companies use different approaches, they all agree that the two most important factors are the same. These are your payment history and credit usage, which is the percentage of credit that is actually used. Your credit score will be affected if you make late payments.

Your credit score can be affected by how old your accounts are. The older your account is, the better. Closed accounts that are not in default can count against your score. Manage all credit accounts, and make sure they are active. A variety of accounts can make it easier to manage your credit. Lenders love to see you have multiple accounts and can handle multiple types payments.

Impact of a low credit score on your ability to qualify for a loan or credit card

Bad credit could be the reason you aren't able to get a job. You may notice a decline in your credit score if you miss several payments. Same goes for loans. With a low credit score, you might not be able to get the best interest rates. You might also have trouble acquiring certain services, such as a home, and a job. Your ability to get housing can be hindered by bad credit.

Credit score can be affected by many things, but a low credit score is the most difficult. Paying on time is the most important aspect. Negative credit scores can result from missed payments. Your payment history is an important factor in lenders wanting to make sure you are able to repay their debt. 90 percent of the top lenders will use your payment history as a factor in determining 35% of FICO(r).

Credit consolidation is a way to improve your credit score.

One of the best ways to fix a low credit score is to use debt consolidation as a way to pay off your debts. With debt consolidation, you can make one monthly payment and lower the interest rate. And you can lower your monthly payments by using autopay. But beware of your credit score! Low credit score can make it difficult to qualify for certain debt consolidation options, and you should read all the fine print. To improve your credit score before applying for a consolidation loan, you should fix your spending problems first.

If you have multiple debts, debt consolidation can help you simplify your payments by consolidating them into one low monthly payment. Your payments will be easier if you only have one payment. This can also help you avoid missing payments which could lower your credit score. However, debt consolidation is only beneficial if it has a lower interest rate than the credit card debt you are carrying. For example, if you're paying 16 percent to 20 percent APR, debt consolidation could help you save hundreds of dollars each month.