High credit scores are not necessarily bad. But mistakes made in the past can cause you to be turned down for a credit card. Diane Elizabeth is a woman with excellent credit scores. However, she was denied credit because of two late payments on one her credit cards in the past five years. After contacting the bank, she was successful in reapplying.

Low credit utilization

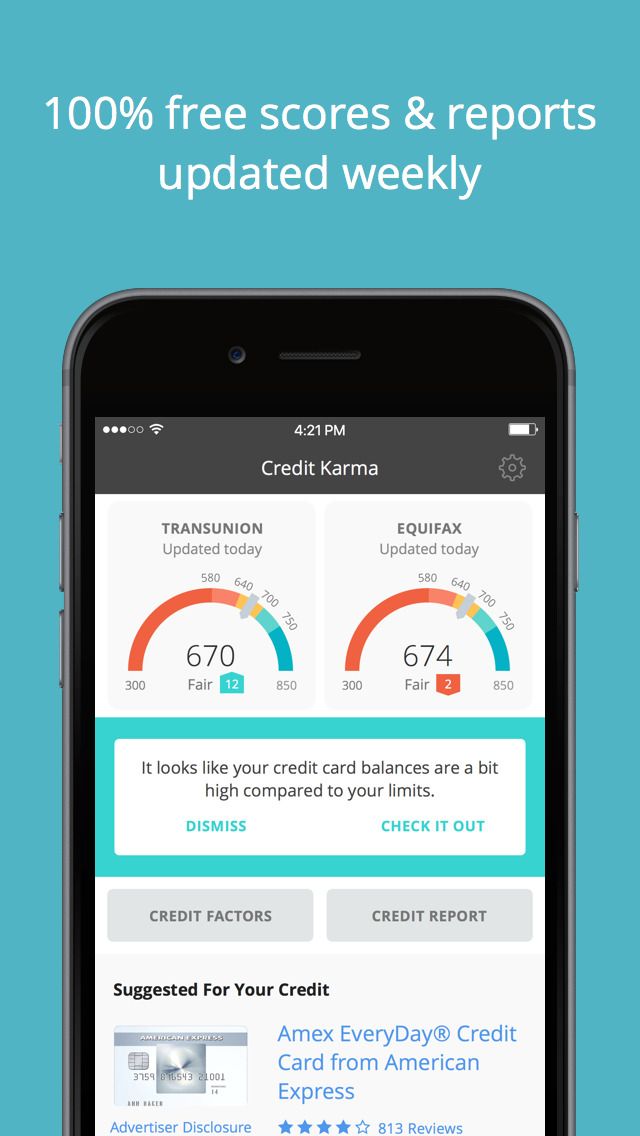

A high credit utilization ratio can negatively impact your credit score. There are many ways to reduce your credit utilization ratio. First, be sure to limit the amount you spend on credit cards. You should avoid using them to their maximum limits, as this will result in a high credit utilization ratio.

One type of credit

Credit mix (or the combination of several types of credit) can affect your credit score. This makes up about 10% of your overall score. If you only have one type of credit, your score will likely be lower than you'd like. There are many ways to improve your score. You can use different types of credit, or reduce your utilization.

Late payments

Your credit score might be negatively affected if there are regular late payments. However, there are ways to avoid being late and to improve your credit score. It is important to make timely payments and pay off past due payments. While it won't erase past late payments, it can increase your payment history.

Multiple credit cards

Having several credit cards is a great way to raise your credit score, but you should also know the risks involved. Multiple credit cards can make your credit history look bad and could lead to increased debt and credit checks. This could not only lower your credit limit, but also hurt your credit score. It is best to only have one or two credit accounts with zero balances. You will be able to only use them when absolutely necessary.

An extensive credit history

The length of your credit history is an important factor in your credit score. This is because the longer your credit history, the higher your score will be. You also need to consider how many accounts are you currently have. A longer credit history will make it less likely that you miss payments. Although you can reduce the length of credit history by closing older accounts, this will decrease your average age of accounts. Credit score is also affected by the age of your oldest account.

A solid payment history

Your credit score will be affected by how you pay your bills. Your credit score will rise if you pay your bills on-time. But late payments can impact your score. Remember that late payments on older accounts may affect your score more than the ones that are current.

Keep track your debt

It is crucial to keep track of your credit when you have too much credit. Your credit utilization is the basis of a third your FICO score. If your debt is too high, you may have to reduce the amount you borrow to improve your score.