Obtaining a First Access Visa Credit Card is a fast, easy process. After you submit your application, you will be asked to enter a 9-character reservation code. You might get a card with a different style because of limited availability. You won't be charged for Premium Design in this instance.

Solid Black Visa(r), Card

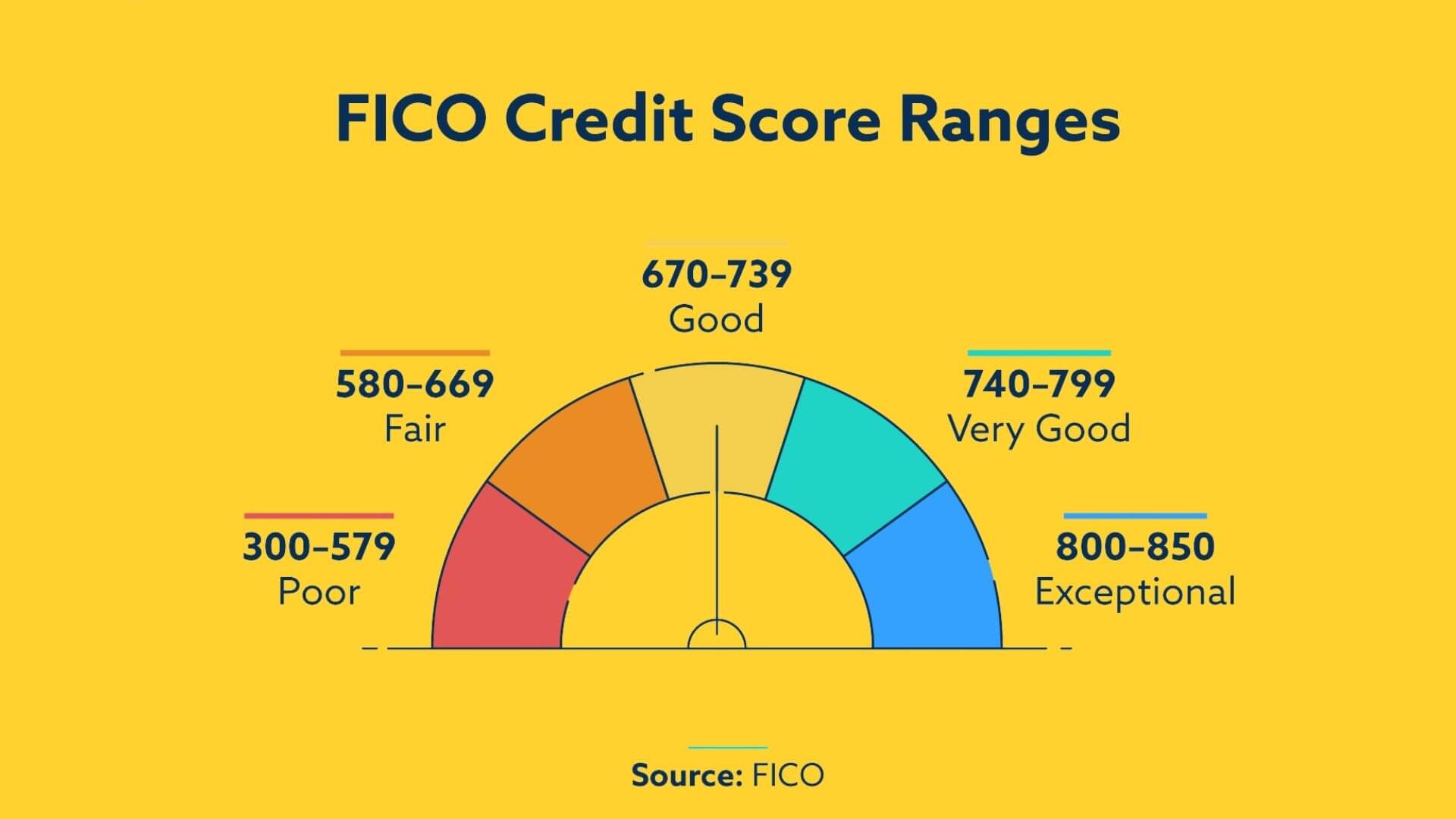

If you have a poor credit score and want a credit card that can help you build your credit, consider applying for the First Access Solid Black Visa(r) card. The application is simple and secure. Your approval will come within 60 seconds. This card is an excellent option for those with no credit history or little credit.

Although this credit card offers a higher interest rate than other credit cards, the annual fee is lower than that of a competing card. The first year's fee is waived, and the annual fee is discounted to three percent. The only fee that you will have to pay after the first year is waived.

Petal 1 card

Petal 1 Visa Credit Card with No Annual Fee offers a 2% - 10% cash back rewards program. You can redeem your rewards for a statement credit (ACH transfer), a check, or a cash back reward. To see local deals, you can also download Petal 1's app. You will be able to see the best deals, and you can redeem them for gifts or free items.

You will need an email address, U.S. telephone number and social security number to get started. You will also need a government-issued photo identification. An account in a bank is required. Those who don't have a bank account may not be eligible for Petal card first access.

Once you've registered, you can manage your account online. Online payment of your credit card bill and viewing your account activity are all possible. You can also change your password and set up automatic payments.

Capital One Platinum Secured credit card

Capital One Platinum secured credit card is an excellent option for people who require a secured loan with minimal or no annual fees. The credit card has a $200 credit limit, and only a small deposit is required. This credit card allows you to build credit history, improve your credit score and create credit history. You can spend as much as you like, provided you keep the minimum monthly balance.

Capital One Platinum secured credit card offers a 200 credit line. It can also be increased upto $1,000. The initial access credit limit depends on the security deposit made. Additional deposits can increase this credit limit as needed. However, you must complete this process within 80 days of receiving the card.