It is possible that you don't know your credit score if credit has never been used before. This is why it's so important to quickly learn how to build credit. There are several steps you can take in order to build a good credit score. It is important to start building a credit record. In most cases this means opening at least one credit card.

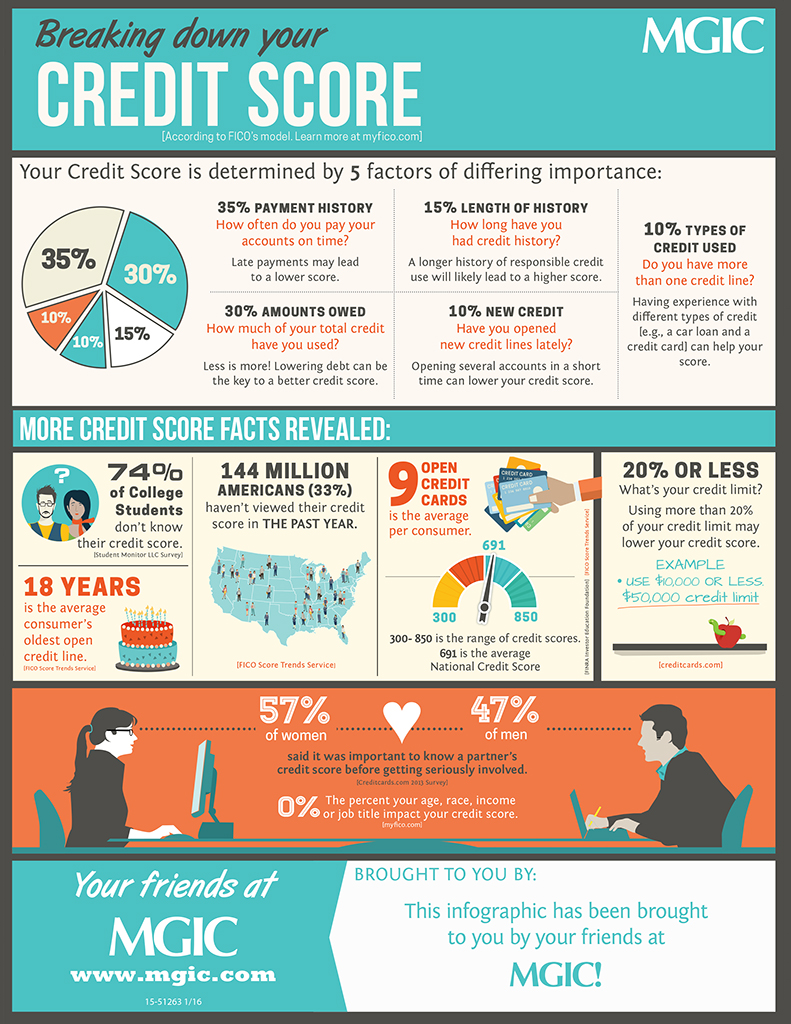

Credit mix

A key factor in determining credit scores is the mix of your credit cards. Your credit score will also be affected by your percentage of revolving and installment credit. Credit utilization is another important component of credit score. You will have lower credit utilization percentage if you have a combination of revolving as well as installment accounts.

History of payments

Your payment record is one of the most important factors in your credit score. Your payment history is a record of how consistent and regular you pay your creditors. It is essential to your credit score. Late payments and missed payments can lead to a lower score. There are ways you can improve your payment history.

Credit utilization

Credit utilization percentage is the percentage of credit that you have used against your total credit. It's calculated by dividing your current balance by your total credit limit on all accounts. You can find this information usually by logging in to your credit card accounts. Bankrate.com also offers a credit utilization calculator that can help you calculate it. For example, if you have a credit card with a $5,000 limit and have spent $500 on it, your credit utilization is ten percent.

Credit history length

Your credit score will be affected by your credit history. It accounts for 15% of your overall score, but other factors are also considered. The higher your credit score, the better. Lenders will offer loans to customers who have a longer credit history.

Interest rate

If you're new in the world of credit, it might be tempting to ask, "What credit scores do you need?" The average score for FICO and VantageScore is 300, but this is rarely where you'll begin. Your credit score at the beginning will likely be between 500 and 500. Your credit score will increase quickly as you are a responsible credit-user.