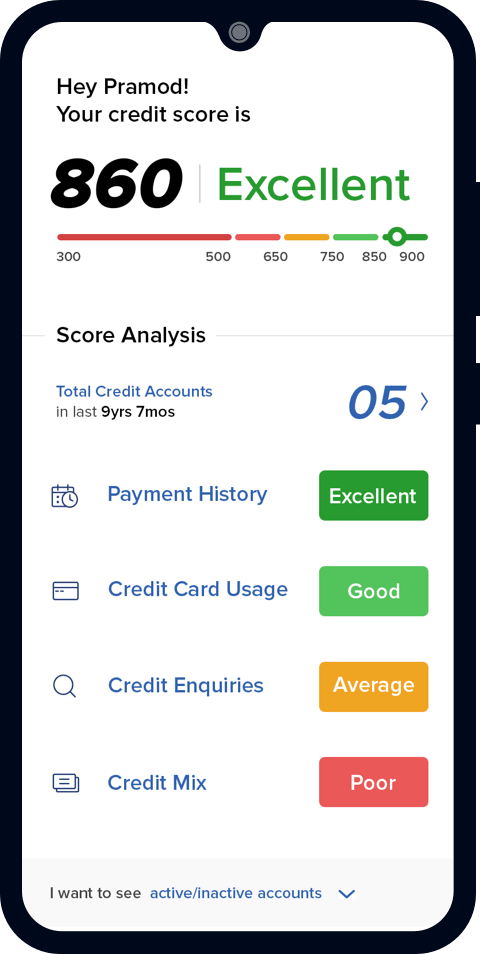

Before you close your credit card, it is important to review your credit history and see how it will change. Request your credit score free of cost from most issuers. There are many websites that provide free credit scores. Although they may not be as precise as FICO scores, these scores can give you an indication of where your credit is at.

Inactive or rarely used credit cards should be closed

While credit cards can be an important financial tool, there may come a time when they are no longer used. You might find that they charge high annual fees, have high interest rates or offer rewards that don't seem enough. Whatever the reason, it's important you understand how closing these accounts will impact your credit score. Also, how to handle this change.

Your FICO Score can be affected by closing a credit card account. It is wise to think carefully about whether closing an inactive, or infrequently used credit cards is in your best interests. Although it won't increase your credit score or reduce the temptation to make excessive charges, closing an inactive account can help you lessen that temptation.

If you want to close an inactive or infrequently-used credit card, first consider a more efficient way to use it. You might open an account for online shopping with the infrequently used credit card. This allows you to make small purchases every few month and pay them off before your next billing cycle. This will allow you to keep your credit limit high and show responsible credit usage.

Cancel cards with an outstanding balance

Contact the credit card issuer to cancel credit cards that have an outstanding balance. The customer service representatives should be able to cancel your account. But, before you close the account, confirm that your balance is at zero. Otherwise, you may find residual interest accruing on the account. A closing of an account could take significant time and effort.

Your credit report may take up to several months before it reflects the cancellation. It doesn't matter how you cancel your card, you should get written confirmation from it. This will allow you to keep track of the date your account was closed. You could be charged additional fees if you don't.

If you aren’t sure whether to cancel a creditcard with an outstanding balance, consult a financial professional. Sometimes, canceling a credit card with a balance can be the best way to help a creditor who isn't able to pay.

Cancel cards with a low balance before closing

Before you close your credit card account, make sure to contact your credit card provider. You'll need tell your credit card provider you would like to cancel the card and confirm that there's no balance. Otherwise, residual interest may begin to accrue after the final bill. Contact them to inquire about a higher rate or reward program.

Contact the credit card issuer to cancel your credit card account. After you close the account, check your credit score between 30-60 days. It should state that you have closed your account and that the remaining balance is $0. However, if it is still listed, you will need a dispute with the credit agencies to have the balance removed from credit reports.

Joint credit cards may be necessary if you are going through divorce or separation. This will prevent you from regretting later purchases. Similar to the above, if your goal is to manage debt, closing a joint card will let you focus on other debts.