There are many choices when it comes to the best credit cards in 2020. There are several options available, including High-tier rewards, Balance transfer and Student cards. How can you decide which card is right for you? Based on our methodology, here's a list containing the best 2020 credit cards. You will find out what we mean. Our methodology has helped us sort through hundreds of offers from over 60 companies.

Interest-free credit cards

A number of attractive deals are available to new cardholders due to the intense competition among credit card issuers. These deals offer interest-free credit cards that last for a period of 12 to 21 month. There is usually no annual fee and no balance transfer fee, but these offers don't last forever. After the initial period, the balance will start accruing interest at the regular rates, which can be anywhere from 12 to 25 percent per year.

In order to avoid paying interest on new purchases, it's important to pay off your balance in full each month. A low-interest card may be better if you have to make large purchases that are not regular monthly. In these cases, it is a good idea to choose an interest-free credit card with a lower annual percentage rate. Even if you have low monthly expenses, you may be eligible for a card with a 0% intro period.

High-tier rewards cards

There are many rewards credit card options, but it is important to keep in mind that interest rate will continue rising throughout the year if your balance remains. You can save money this year by taking advantage of extended 0% balance transfer windows. These deals are available for existing customers and not only new applicants. We have 51 choices for the best rewards cards 2020. They cover 17 categories. They offer strong rewards for all types purchases and follow simple rules.

Chase Freedom Unlimited Credit Card: Get 5% cashback when you make prepaid travel reservations or other purchases with this credit card. Other rewards categories include gas stations, restaurants, and internet purchases. Cash back can be redeemed for any amount. You can apply it as an account credit or bank deposit. You can also use the cash back of 5% to purchase a gift voucher if you wish to give a charity gift. You also get many other perks with the Chase Freedom Unlimited credit card. In exchange for software subscriptions that are eligible, you will receive $100 in credit on your statement.

Student credit cards

A student credit card can help you build credit. You can earn rewards such as air miles and store vouchers when you use your credit card responsibly. If you are unable to pay your monthly balance in full, your rewards will be meaningless. The card issuer may limit the rewards you earn if you are careful with your spending. These tips will help you build good credit.

Before applying for a Student Card, be sure to fully understand the benefits and features that the company offers. A majority of student cards offer 1% cashback when you purchase. Many also offer bonus rewards if the account is opened within the first few weeks. Moreover, most student cards report to all three major credit bureaus. Therefore, you can add years of positive information to your credit report by making payments on time.

Balance transfer cards

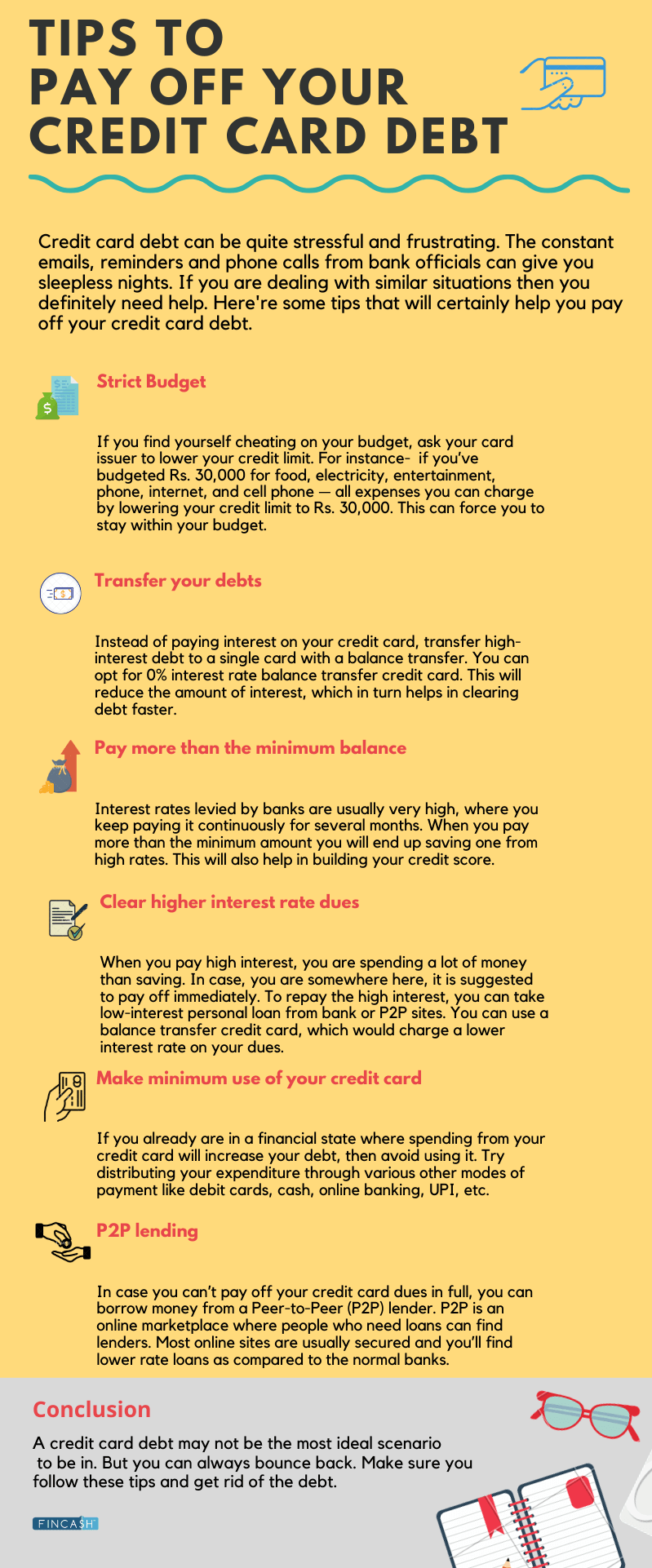

Balance transfer credit cards should be evaluated based on your credit score, the amount of debt you have, and whether you are able to afford the high interest. These factors will determine which balance transfer credit card is best for you. This comparison has helped make it easier to compare hundreds of cards. There are five cards that don't have an annual fee and none that do.

One of the many benefits of balance transfer credit card is that you can consolidate your debt into a single monthly payment. If you have excellent credit, you can take advantage of the best offers. The best balance transfer card offers an introductory period. After this, your balance will continue to be charged at a normal APR. Some offer cash back rewards, while others have modest cashback options. Balance transfer credit cards can be a great option for those who want to quickly pay off their debt.