The Discover It Secured Credit Card is a great creditcard that rewards you for every purchase. This card is unique because it offers unlimited cash back of 1% on all purchases. To avoid penalties, be responsible with your card and not exceed 30%.

Credit limit very low

The Discover it secured Card has a low credit limit. However, you can still earn cashback rewards of 1%. There is a $200 security fee and a credit limit of $2,500. This card is ideal for rebuilding your credit history and repairing your credit. You will need to make a $200 security payment to get the card started. But, you can always get more if you upgrade to a greater credit limit.

The required security deposit for this card is $200. This is an average amount for secured cards. However, you should consider the balance transfer fees. The first six months of this card are free from balance transfer fees, but after that you'll be charged 5 percent. Still, this is a good way to start building credit and avoid paying high finance charges.

There is no annual charge

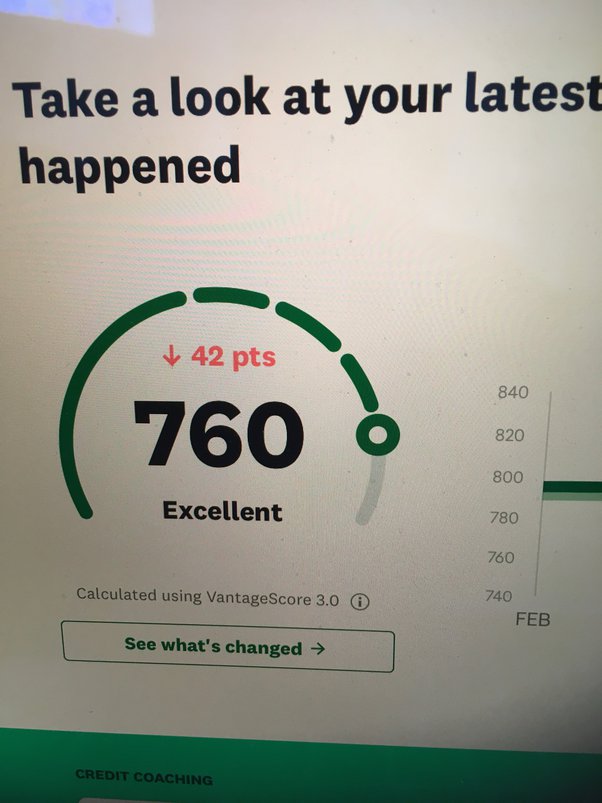

The Discover it Secured credit cards do not require an annual fee, and are great for people with poor credit. The card also offers rewards and a return of the security deposit. Its variable APR is the downside. Before applying for this card, it is a good idea to have a look at your credit history.

The Discover it Secured card requires a $200 security deposit, which is in the middle of the road when it comes to secured cards. You will also be charged a balance transfer fee, which is 3 percent during the first six-months and then goes up to five percent thereafter. You may be able to get this card for very low credit. But it is worth taking the time to review all aspects of the card before applying.

Requires $200 security deposit

You will need to provide a $200 security deposit when you apply for a Discover it Secured credit card. The security deposit will be used for any outstanding account balances. After seven months, the card can be changed to a traditional Discover credit card. This card does NOT charge foreign transaction fees. A $200 security deposit is required for this card. However, you can deposit lower amounts if your funds are less.

The Discover it Secured Credit card is a great choice if you don't mind paying $200 for a security deposit. It does not have an annual fee, and you get cashback. So you can use it for rewards and improving your credit history. However, the card is not as widely accepted as other credit cards. This makes it more difficult to use the card at certain merchants and in foreign countries.

APR Rates Regular - See Terms

The Regular See Terms APR is an interest rate for a loan. It is calculated using your credit score. APRs are lower for people with good credit than those who have bad credit. This is because lenders view those with poor credit as a liability rather than a profit source. However, not all lenders offer this rate.

The APR can be used to save money accounts. A savings account earning 1% withdrawal fees would earn 8.9% per calendar month for a period of one year. The APR is not a comprehensive way to determine the cost of borrowing. However, it can provide an estimate of the total cost of the loan. If you're borrowing money to make a big purchase, understanding the Regular See Terms APR can help you make an informed decision.